Real estate investment is a form of financial investment that involves the ownership of a property for profit. Moreover, it involves all the revenue-generating methods that revolve around owning a property. These include renting the property out to someone and the buying and selling of properties that apply the same economic principles to maximize your profit.

Hence, real estate investments promise profit because of supply and demand-driven increases in value. Owning a property also costs you the price of maintenance and taxes. However, you can still achieve profit if the value of the property surpasses your overall cost.

Types of Property Investment Strategies

Veteran investors manage to make an incredible amount out of real estate investments by having a proper investment strategy. There are two main real estate investment strategies – long term and short term. Short-term investment involves buying property to sell it for profit after an increase in value. Short-term investment, or flipping, is a quick-term investment for profit in less amount of time.

On the other hand, in long-term investment, real estate investors buy property to lease or rent it out to people. With long-term real estate investment, you can earn more frequently from rent and capitalize on the increase in value over a long period.

Quick Turn Investment / Short-Term Investment

For quick turn investments, you need to stay up to date about the property prices, trends, potential property markets and have keen insight into peoples’ demands. Timing is everything when it comes to quick-term investments. Hence, a quick turn investor needs to be fully aware of the market and act swiftly in response to the economy. The two biggest focus strategies for quick turn investment are retail and wholesale.

Wholesale strategy requires smart and sharp moves and relates to brokerage work. A wholesale investor finds potential properties and agrees to buy them for the original price by signing the contract. After that, the wholesale investor looks for buyers interested in paying a higher price for that property and sells it to them. The new buyer pays the extra money for that property in the form of a fee, which is the wholesale buyer’s profit.

Furthermore, retail, short-term investment is what you would call flipping, in which you buy an undervalued property in a potentially marketable area. This allows you to renovate that property so that it increases in value, and you can sell it for profit.

Long-Term Investment

Long-term investments are generally safer options in terms of real estate investments. It does not promise quick conversions like a short-term investment. However, renting out property allows you to save your money by using rent money for mortgage and repairs. This way, you can keep the property without having to pay any additional charges and sell it for a profit once the value increases. By increasing the rent, you can also create a substantial monthly income stream.

To Conclude

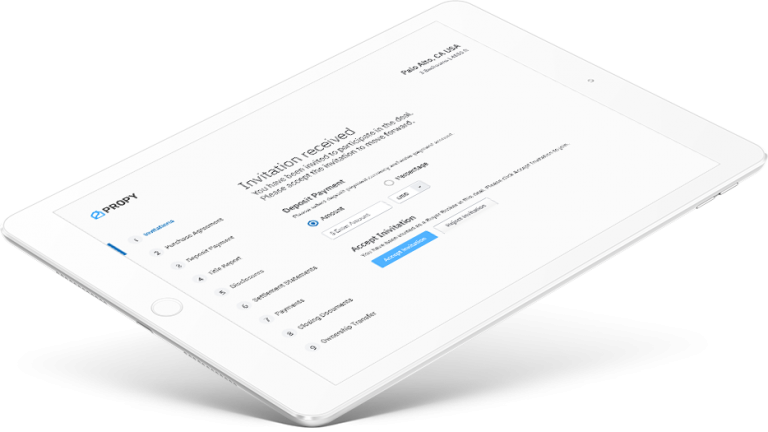

Real estate is one of the best investments in the world. Whether short term or long term, both promise a hefty and steady return because of property prices. Nowadays, digitalization is making real estate procedures easier and accessible. Software like Propy provide you with an automated system for real estate transactions, saving you the time, and ridding you from complications.