Emerging from the dirt and destruction of the 2008 financial collapse, Marc Andreessen and Ben Horowitz seemingly pulled a VC empire out of thin air. Now, the firm that they founded, Andreessen Horowitz (also known as “a16z”), is going in a new direction. One of the firm’s targets is blockchain technology.

Andreessen Horowitz and the SEC

Andreessen Horowitz enjoyed massive success as a firm, but it hit a wall with the SEC. One of the SEC’s rules is a 20% cap on the stakes that traditional VC funds can have when it comes to secondary purchases and fund or token investments (such as cryptocurrencies). For that reason, a16z is renouncing its status as a venture capital firm. Instead, Mark Andreessen and Ben Horowitz are registering the entire firm as a financial advisor, a process which requires reviews of all 150 people who work there.

a16z Wants to Dig Deeper into Blockchain

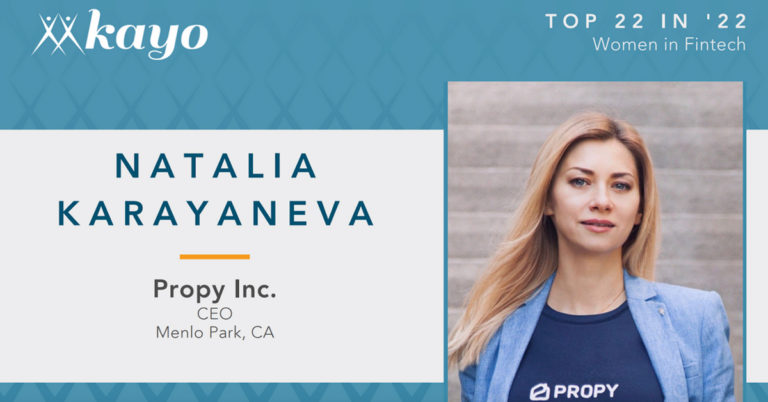

Once a16z switches its status to that of a financial advisor, it will be able to surpass previous deal limitations. Andreessen Horowitz partner Katie Haun states that the partners will be able to share deals such as those involving “a blockchain startup for home buying”. Even more, the a16z crypto fund indicates on its website that it intends to be consistent with investing in crypto.

The Old and New Worlds Collide

With regulation and government cooperation, old barriers will be overcome. The recent news of Andreessen Horowitz’s registration for another legal status indicates that there will potentially be changes for the entire blockchain industry.

The change seemingly gives the seal of approval for blockchain startups. Even more, real estate firms using this new technology seem to be uniquely positioned for future creative deals.