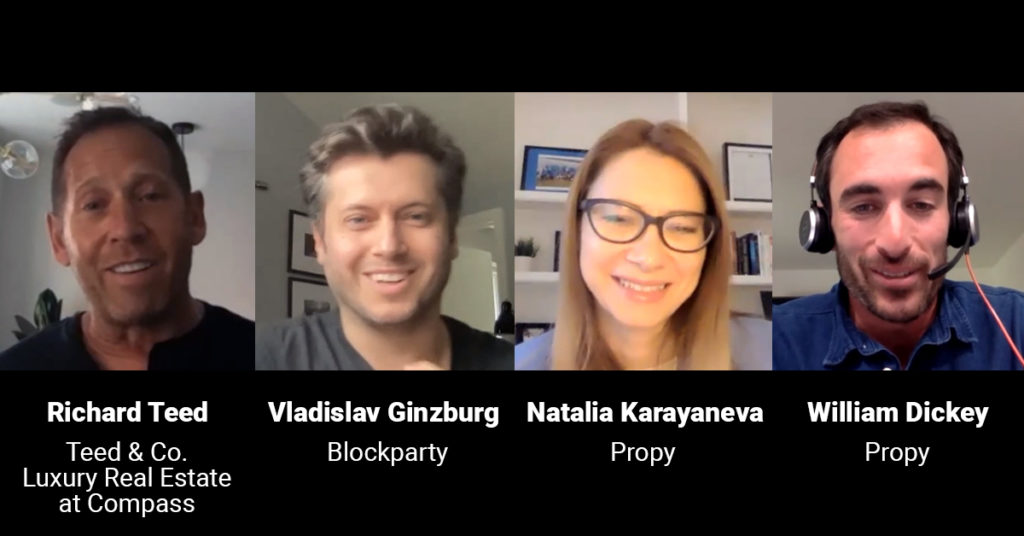

Propy’s weekly webinar Episode #48 is with Rick Teed, Founder of Teed & Co. Luxury Real Estate at Compass and Vladislav Ginzburg, CEO of Blockparty.

Propy’s CEO Natalia Karayaneva and William Dickey, Tech advisor are joined by Rick Teed, Founder of Teed & Co. Luxury Real Estate at Compass and Vladislav Ginzburg, CEO of Blockparty to discuss non-fungible tokens (NFTs), the hottest topic in the crypto space.

Natalia explains that non-fungible tokens (NFTs), have become all the rage recently since Mark Cuban, Gary Vee, and Elon Musk have become fans recently. NFTs are cryptographic tokens existing on the blockchain that represents something unique like a piece of art, music, or a collectible.

Background

Vlad Ginzburg initially thought of NFTs as event tickets. These began as the ERC 721 standard on Ethereum, in which every token is a fully unique asset with Ethereum. That’s different, he explains, than ERC 20, which are tokens that are totally fungible with each other.

As a music fan, the analogy that Vlad made was ERC 20 was like a General Admission ticket, and ERC 721 was like a ticket for a seat in terms of the metadata regarding where you sit. So much of what we transact in our every day life, other than commodities, are inherently non fungible. If you use an NFT as an idea to capture whatever non-fungible commerce you’re talking about, then you can tokenize almost anything. That got his company to where it is today by tokenizing music, sports, arts and other cultural assets.

He explains that since about 2010, in the fine art world, certificates of authenticity aren’t issued anymore because the fakes had become too good, and they couldn’t tell what was real anymore. The art world moved to a certificate of title system. That started to really look and feel a lot like the real estate business where you get a certificate of title. When you sell your artwork, no one can say, “this is the one true artwork”, but you can say that you are the owner of this artwork, and then based on where you got the previous ownership of title, the piece can be traced back to see if it is legitimate.

In 2017, when he was first exposed to a real estate title on blockchain, Vlad thought to himself that this isn’t really any different than what he saw selling a piece of digital art on blockchain. When he first saw the Propy Certificate of title that was registered in Ethereum, he felt that was a non-fungible token because you’re conferring ownership of this real asset in a digital way.

That concept was very exciting for people in the non-fungible token space. Vlad shares that everybody working in NFT’s three years ago basically had the same “aha” moment when no matter what corner of ownership they’re working on, they realize this applies to everything.

Rick Teed is a realtor in San Francisco who has done a number of transactions using crypto and was one of the first agents to do a blockchain transaction using Propy. He explains that anything you can digitize, you can fractionalize. He shares the example from 25-30 years ago in real estate when people bought timeshares. Today, timeshares have turned into what is Airbnb and VRBO. Basically, what you’re doing is you’re selling a property two-and-a-half to three times for the same asset by buying into a timeshare.

Rick doesn’t consider a home a liquid asset. There are a lot of people that would like to say, Hey, I own that house, even though I don’t live there. But I’m sharing in the upside. These are the key parts of learning how adoption is going to happen in the mainstream.

As an example, Rick shares the recent story about the Kings of Leon releasing their album as an NFT. The fanbase for this band didn’t know anything about NFTs or how to buy Ethereum or Bitcoin, so how were they going to start buying a digital album, concert tickets, and all the special perks being offered? Fortunately, someone in the band knew Bill at Abra and contacted him. Bill spent the weekend providing Ethereum so these fans could actually bid on the prize that they wanted.

Looking at real estate, Rick explains that if you can fractionalized it and digitized it, you don’t actually have to live in the house as long as you’re betting on the upside of that property if someone wants a loan. This is what will drive it. Holders of Bitcoin and Ethereum are never going to sell because of the taxation, but people will borrow against that.

Rick continues by saying that if he wants to borrow to buy a property, and perhaps he wants to do that with 10 people. On the title, it’s one property; you can’t duplicate that exact asset. It is a non-fungible asset. You can fractionalize it, and this is going to unlock liquidity in assets. Whether you have a Picasso hanging on the wall that has a digital tag on it, which means it’s the only one, you don’t have to have that in your living room, but you could say “I own a Picasso”.

Rick says we have to look at really the big picture here about what’s going to happen, which is why he really loves Propy. He doesn’t understand why real estate agents don’t understand the importance of posting titles on a blockchain. It will dramatically eliminate the need for a) title insurance and b) lawyers because all the information is there for everyone to see. Because of the nature of blockchain, you will know exactly when something happened because every aspect is time stamped. He feels that this really demystifies a lot of things.

Vlad agrees with Rick and explains that as he is in the NFT space, he is championing digital title all the time. The industry has a long way to go still and needs to do a better job of helping people understand what a digital title really means.

Going back to the Kings of Leon example, Vlad explained that the fans had heard of NFT but didn’t understand it. They needed to understand how this was different from buying the album on Spotify.

Selling upside and fractionalizing things does trigger securities laws. It doesn’t matter if it is a Picasso or real estate, just by virtue of using a token to do it, and selling upside, you’re triggering all sorts of securities laws.

Natalia explains that at Propy, they are putting every title document on the NFT. When ownership transfers from one person to another, it does not concern the security laws, but if you do fractional ownership, that needs to be registered with the SEC. Every single transaction on Propy is recorded on the blockchain and is immutable. Propy has been issuing a blockchain Certificate of ownership, and that has been done by smart contracts, which are unlocked with traditional ERC 20 tokens. Propy is discussing how to put the blockchain certificate into the NFT or the ERC 721 token.

What is most confusing about NFT

Willie states that when he first started to explore NFTs, his main question was in terms of ownership representation. Coming from a finance background, whether you’re securitizing a loan, or are buying stock which represents a fractional ownership of a company or an asset, he has not been able understand this differentiate from an NFT.

Vlad says the best way to explain this is the NFT derives value from whatever the things are that make it unique. Every single token on the blockchain must be different than any other token. The blockchain itself has no value; the only value are the things that it represents. As Natalia pointed out, you can sell the ownership of a whole house as a single NFT.

There’s another NFT called ERC 1155. That is when the smart contract that governs the NFT can be subdivided into an infinite number of sub-contracts, Vlad explains. Imagine an NFT as a vending machine, which is the master contract. Within the vending machine, you have lots of little versions of the vending machine. Vlad feels this is a simple way to differentiate an NFT that is a certificate of title, or a digital title for one property, or a property or one building with units inside of it being partitioned off as NFT.

How is a royalty or commission paid when artwork or music is sold using NFTs

Vlad responds that blockchain is special because of its immutable ledger of transactions. He explains blockchain as “an internet of transactions where a global network of servers all witnessed each transaction.” When you use NFT tokens, you can see on the ledger where every token has been, and that provides the provenance and chain of title of these NFTs.

In real estate transactions using blockchain, a smart contract is used, which is simply an automatic escrow system. NFTs must be governed by a smart contract as well, and that contract is what governs the behavior of that token. Because of this smart contract, it can be programmed so that every time a token transacts on the blockchain, that a portion of the price of the transaction is returned to the originator or a specified wallet address.

In the example of art, we are seeing this with many digital artists. Every time an NFT is bought and resold, a percentage of every sale is automatically routed back to the original artist’s wallet.

Rick explains that there are so many auctions and different transactions happening with NFTs now. He always wants to identify the use case and understand why this matters. He believes that very soon, we will know how to make NFTs work on a digital and fractionalized basis so that it really applies to home buying.

Using Vlad’s example of how a piece of art can be sold multiple times, Rick gives a similar example that you have a house, and there are tokens exchanged to sell the property to multiple people at one time, with no ability to gain from the upside of the property. Tokens are held onto tightly, but as the value of the tokens go up, a person could take some of the tokens and buy a separate property. By doing this, you can still have the original group, or person, who can trade in and out of the tokens as a use, or rights, to the property. This has nothing to do with gaining the value, but their value gained would be to eventually have more than one house.

There will be early use cases, and lawyers will figure out how to make it work. The government, fearing the changes that are happening too fast, will add rules to slow this process down until everyone can get up to speed on it.

Rick continues by saying this is like how people said an ETF (exchange-traded fund) wasn’t ever going to happen, but they are happening. He brings up MicroStrategy as an example and explains that this company is a publicly-traded company that is essentially a SaaS product. The company was founded in 1989, and their stock has held around $145 a share for the past five years. The CEO, Michael Saylor, decided to purchase Bitcoin when it was around $11,200, and initially purchased about $435 million of Bitcoin. He is now up to over $2 billion dollars worth of Bitcoin as a treasury. Why does this matter? Their stock had historically stayed in about the same place for many years, but now that there is $2 billion of Bitcoin in their corporate bank account, MicroStrategy’s corporate treasury is swelling, and their stock has quadrupled to $600 and is exploding. Saylor started to have Clubhouse and Zoom calls explaining his playbook on why to buy Bitcoin as treasury and recently had 25,000 CEOs of small and medium businesses on a call.

How are physical world assets such as cars, aircraft, boats, real estate tied to NFTs

Vlad explains it helps to think about an NFT as a digital certificate of title or a digital certificate of authenticity for artwork. However, the problem is always tying the physical object to the digital object. There is emerging technology, for example, like what your iPhone uses to recognize your face and unlock your phone, that has been developed for objects. The technology takes the image recognition and creates code into it. He has seen companies that are capturing an image and hashing that code directly into the smart contract. He has seen this work with 100 individual baseball cards that then could be told apart individually.

For aircraft, boats, and cars, Vlad explains that there is so much metadata available, such as serial numbers, title numbers, make, year, model, etc., that can all be added to the blockchain to be captured by the NFT. Paper documents like certificates of title are going to become extinct. Blockchain is a safe, secure, and immutable way to store a global list of transactions. There is no reason why home deeds cannot be represented as tokens on a blockchain.

Natalia explains that every transaction done on Propy has a blockchain certificate of title at the end of the transaction. In a few weeks, Propy will be producing NFTs ERC 721. The majority of states in the USA now have blockchain laws that state that if you have a blockchain certificate and record of the transaction, you can claim ownership of that property. This is your evidence that a transaction has happened and is accepted in court as proof.

Future lending practices

Rick shares an idea he has about a potential use for NFTs in development. When a developer has land, they could put an NFT on it, and anyone could buy the tokens. The tokens would fund the construction of the units or the hotel. Instead of developers going to big banks or Wall Street for funding, people can participate in NFTs in small ways. His dream is that anyone who holds Bitcoin will become a banker, a “you” bank. That person can use algorithms to decide whether or not to participate in an investment, and they can choose where to put their Bitcoin. It will be complicated for a while, and the SEC will be involved, but over time the fear of this will go away.

Rick states that in other parts of the world, for example, Venezuela, Argentina, and many African countries, people know how to buy Bitcoin because their countries are bankrupt. People learn how to do new things by force. When people go to Abra or Blockfly and see they can earn 5% on Bitcoin and 10% on cash, then go to Uniswap or Sushiswap and see they can earn 7-8%, they will figure out how to do this because they want the extra money. Lending as we know it with banks is going to go away because when you have a worldwide network of people who have a little faith in you and are willing to invest in you, you won’t want to deal with the pressures of working with a bank and their requirements.

Vlad explains that when you tap into a decentralized network of liquidity providers, things will get interesting. He believes that this will absolutely become part of the future, and in fact, in the crypto world, people already participate in decentralized exchanges. Lending practices in the future of real estate will certainly see change as NFTs become more mainstream.

Natalia says it will be amazing when you can have a property as an NFT and use it as collateral to get money from the crypto community within hours and not have a big approval process to go through. She shares that when the crypto movement started about 10 years ago, only nerds and engineers were interested in it. Then, last year there was a spike of activity when CEOs decided it was their fiduciary duty to put some company money into Bitcoin. And now we’re seeing the creative communities getting on board because of NFTs. She believes it’s a huge opportunity for the real estate community to become involved now.

Advice on getting started in NFT and Bitcoin

Vlad explains that many musicians and artists are not crypto people, but they are business people whether they realize it or not. Consumer behavior and business behaviors impact who we behave as individuals.

For example, Vlad states that musicians used to be in the business of selling records, but that got replaced by streaming and the amount of money that musicians were getting paid to sell recorded versions of their music dropped drastically. The result of this was the quality of concerts and live events went through the roof because musicians had to go on tour to make money they used to. Now we are seeing musicians redefining the way they create ownership around their music or content.

What Vlad would say to real estate agents is to bet on your industry being the next one to get excited about cryptocurrency. Get ready for this new trend by getting familiar with some of the concepts we’ve discussed today. The easiest thing to do is buy a little bit of Bitcoin, even if you don’t know anything about it. Buy $5 or $100 of Bitcoin from Coinbase. And then start touching some of the apps like Metamask. Look at Uniswap and Sushiswap. Those are advanced platforms, but they are easy to learn because the interfaces are getting easier and more comfortable. Get acquainted with it, go on Clubhouse and start learning about it. His best advice is to start the education process now.

Talking the same language as your clients

Rick says he has a serious love affair with the alternative currency, which he says is obvious when people talk to him. He urges people to get some Bitcoin or Ethereum. While he has clients who own a lot of these cryptocurrencies, he doesn’t see them transacting in it yet, because of the capital gains involved. What is starting to happen is people are borrowing against their Bitcoin holdings, and this is unlocking the liquidity of that Bitcoin. Holders of Bitcoin and other cryptocurrencies are not going to sell their tokens because they believe the price is going to continue to grow.

Rick believes that people will borrow money against their crypto assets to buy art or other NFTs because they believe that item will go up in value. They will be making bets that the NFT is going to go up in value faster than Bitcoin.

Recommended platforms

Vlad suggests people visit his company, Blockparty.co to learn more about this intersection with music and art.

Underneath the hood of Blockparty is our NFT protocol, which is led by our CTO Joseph Shella. That is available at NFT.org. An NFT protocol is not just for the music, sports and art that they talk about on the Blockparty front end. This is a great resource to learn more about what NFTs can be.