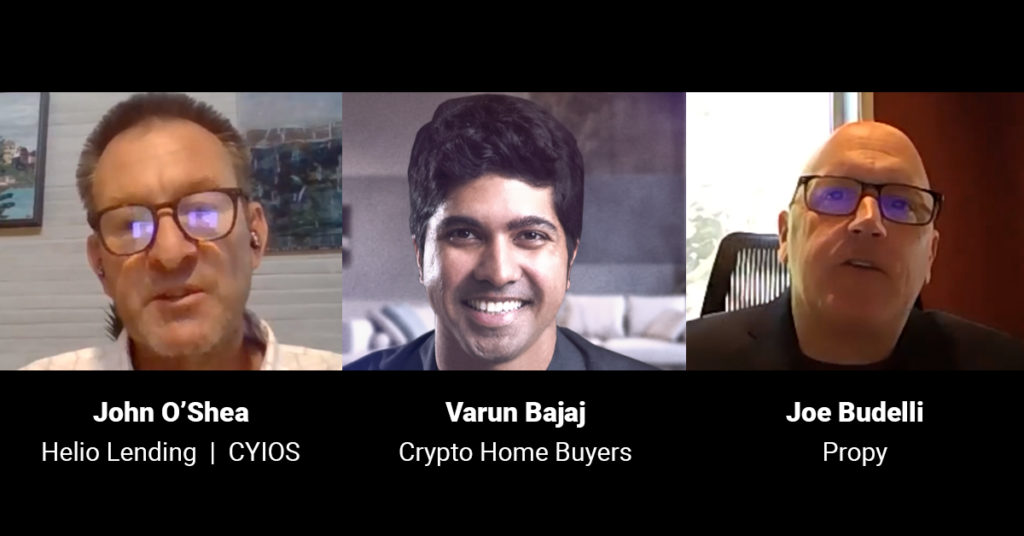

John O’Shea, CEO and Founder of Helio Lending and Chairman of the Board at CYIOS Corporation and Varun Bajaj, Director RKB Investments join Propy’s CRO, Joe Budelli and Gwyneth Iredale, the head of Propy’s customer success team in this week’s webinar.

John O’Shea, CEO and Founder of Helio Lending and Chairman of the Board at CYIOS Corporation and Varun Bajaj, Director RKB Investments join Propy’s CRO, Joe Budelli and Gwyneth Iredale, the head of Propy’s customer success team to discuss how to unlock your clients’ crypto assets to fund real estate purchases, how to utilize cryptocurrency loans to purchase hard assets, such as real estate and much more.

Background

John O’Shea has a strong background in financial services, having spent 35 years working for stock brokers, funds management, and banks. He has a breadth of experience in lending. Two years ago, John established Helio Lending, a crypto-backed lending company based in Australia, with global reach.

Varun Bajaj is self-professed cryptocurrency veteran, having bought his first Bitcoin in 2013. He is an Attorney at Law, real estate broker, and the Director of a $30 million investment portfolio for RKB Investments. Varun is also part of The Real Estate Alliance, and he provides a perspective about the crypto side of real estate.

Getting a home loan using crypto

John explains that using crypto for a loan is actually a very simple process, and in many ways is easier than getting a traditional loan. Typically Helio can do a loan from start to finish in about 24 hours. The first step, of course, is the loan applicant must already own crypto.

After taking the applicant through all the terms and conditions of the loan, the percentage of cash that will be given to you at the end of the loan process is calculated. This percentage is determined by the Loan-to-value ratio (LVR). For example, if the lending company uses 50% LVR on your loan, you will receive 50% of that assets that you hold in fiat or US dollars.

The applicant goes through a very simple “Know Your Client” (KYC) process that is similar to opening a trading or bank account, such as providing photo ID and proof of address. However, there are no credit checks or other financials required, and the lending company doesn’t even need to know how you are going to use the funds.

At this point, your assets of Bitcoin or other cryptocurrency will be transferred out of your trading account or your cold storage wallet, into the lending company’s wallet. As soon as that cryptocurrency hits the lenders account, the fiat will be released within 12 hours.

How does this process compare to a normal mortgage loan?

John explains that applying for a mortgage loan from a traditional bank is going to require more information regarding assets, liabilities, and use of funds, and the process can be very time consuming. He shares that it took three weeks to fund a loan the last time he applied for a mortgage through a traditional bank.

Using a decentralized financial institution (referred to as DeFi) has very simplistic processes that allow the funding to occur very quickly, however, fundamentally it works the same way as a traditional bank.

Who are the lenders on the Helio platform and what are the fees?

John explains that they have all the major lenders such as Celsius and Salt that are available in the market, but Helio also offers some unique offerings as well. All loans have different requirements, and at Helio, they have gone out and done the work for their clients in finding the perfect loan.

“Fees are important,” John states,

“But they’re not the fundamental underlying concern. Security and protection of the underlying asset is number one.”

He continues by saying that the client’s assets are insured and protected.

Loan terms are much shorter than with a traditional mortgage loan, and can go from one month to one year. If you have a loan of 1, 3, or 6 months, you can roll them over at the end of that term. The only fee you pay on the loan is the interest, which varies depending on supply and demand, and can run from zero interest up to around 12%. Helio is very flexible on how the loan is paid down and on the terms.

Helio is a global company, and they can take loans from anywhere around the world.

Can homebuyers using crypto take advantage of tax incentives of having a mortgage?

John states that there is no difference from a tax perspective on getting your loan using crypto vs. a traditional loan. “In fact,” he goes on to explain,

“The beauty of taking out a crypto loan and using that asset, from a tax point of view, is you haven’t actually sold your underlying asset.”

John explains it this way: If you have $100,000 in cryptocurrency that you’re going to turn into a loan, you still own that asset. You are simply transferring ownership to another party to use some of that asset as cash to purchase a property, or use in whatever way you desire. It’s very much like a traditional loan, just at this time, you’re using an asset that traditional financial institutions don’t grade as an asset like Helio Lending does. Bitcoin currently has over a billion dollars of assets sitting there, and Helio wanted to be able to unpack the liquidity of those assets so people could use it for their mortgages.

Where to go to find out how to diversify your crypto portfolio?

John states that visiting heliolending.com and contacting them via email or going through the less-than-a-minute loan process is your starting point. One of their advisors will contact you and take you through the entire process and answer all your questions.

How do we get crypto buyers into real estate and get crypto loans?

Varun states that the services Helio Lending is providing will be a game changer in getting more crypto buyers into real estate. He explains that most people holding crypto don’t want to get rid of their currency. Having a way to tap into those assets to purchase a property and not have to sell the crypto will be very appealing to investors. As John mentioned, there are no tax implications to taking out a loan on your crypto because you haven’t actually sold it.

Real estate agents need to become educated in cryptocurrency and brand themselves as a real estate crypto expert. Once an agent starts marketing themselves as knowledgeable in crypto, they will find crypto buyers.

Is a crypto buyer more appealing to a real estate agent?

Varun explains that Bitcoin goes through cycles, and that the current four-year bull run cycle will most likely be ending this year. He believes that because of that, a lot of Bitcoin holders are going to be looking to diversify and get into hard assets alike real estate. He said to capitalize on this trend, agents need to target that audience of crypto people who want to diversify their holdings before the bull run is done.

John agrees with Varun, and says that this diversification of an asset will really help the real estate industry. A lot of people holding crypto may not own real estate, because their major investment was in crypto. Being able to diversify these people into a more traditional investment is positive for them.

John continues by explain that Helio is an aggregator, which means they have developed solutions around a choice. Currently, Helio has seven lending variations on their platform, soon to increase to nearly 10 options. Whether someone is an agent or the purchaser, Helio is able to take all the mystification out of the process, and educate, guide, and handhold the client through the process. The result? The perfect loan to help that individual reach their desired outcome.

What can an agent do to become more knowledgeable about crypto?

Varun explains that the key to this is like in any business: You have to market yourself and put in the work. He advises that agents be prepared to work and not expect overnight success.

Varun shares that Piper Moretti is a colleague and good friend, and that she spent years dedicating herself to the brand and establishing herself as an expert in cryptocurrency. He stresses, however, that there can be more experts in this emerging field.

To become an expert, Varun recommends joining the Clubhouse community where Natalia, Propy’s CEO, and Piper are educating about crypto every Monday at 4pm Pacific time. There is also another Clubhouse on Wednesday, hosted by a different group that has excellent information.

Varun states that crypto real estate is a small niche community right now, so agents who have the interest have every opportunity to become the leader in this space in their community.

The Crypto Real Estate Alliance

Varun explains that this alliance was created in tandem with Propy. The goal of the alliance is to onboard real estate professionals to the Propy platform. In return, the real estate agents are given Propy tokens. This provides exposure for agents to get into crypto. Currently the Propy tokens are valued at about .80 cents each, and a recent campaign offered 1,000 tokens when agents signed up.

Doing this introduces agents about how crypto works. This is critical because, as an agent, if you’re going to work with someone using crypto to buy a house, you have to speak their language. For a crypto investor, it boils down to familiarity, comfort, and knowing that the agent understands what you’re going through.

John agrees with Varun that it’s important to speak the language of the crypto investor. He states that the crypto investor is similar to the people who were involved in IT at the start of the internet. They knew something that other people didn’t know, and they understood how powerful it was. Crypto investors believe in this asset and they understand how it works.

He feels that what Propy is doing with their tokens is a great way to start someone in the crypto journey.

“If you’re not in this space,” John continues,

“In the next five years you are going to be left behind.”

How to become part of The Crypto Real Estate Alliance or become a crypto certified agent

Varun explains that agents need to put in the work and do their research if they truly want to become an expert in this field. However, by joining The Crypto Real Estate Alliance, taking Propy’s Crypto Certified Agent Course, joining Clubhouse and listening to the information there, and attending webinars like this where crypto is discussed, will put agents ahead of the game.

John agrees with Varun that education is key. He explains that cryptocurrency is not overly complicated, but agents need to learn about it to demystify it.

Agents can also follow Varun on Twitter at @VarunBajajEsq and Piper Moretti at @PiperMoretti.

Final thoughts

John states that cryptocurrency is simply tapping into an asset that your client has that you may not have realized is a really good asset to use.

“Education is the key,” he continues,

“Don’t be scared about this. Get involved with it. You’ll really benefit your clients.”

Varun states that Bitcoin is currently around $60,000 and is expected to go up to $250,000. He says,

“Crypto is not going away. In fact, it’s just beginning. And there’s going to be more generational wealth than ever before and these people in crypto are going to be your potential clients. It’s your job to realize this, and to be in the forefront in this industry.”