After the 2007–2008 economic downturn, people have become much more aware of macroeconomic factors and are keeping a close eye on them. Recently in America, three banks were shut down one of them being Signature Bank — named the third-largest bank failure ever in US history.

This triggered numerous conversations if the global financial crisis could repeat itself and what will be the implications. However, today’s housing market appears to be vastly stronger since 2008 compared to what it was then.

If you are curious about why the current housing market should not be compared with that one in 2008, continue reading.

Home loan

As we all know the housing market crash of 2008 was caused by a number of factors, but one of the biggest contributors was the poor structure of home loans. In particular, subprime mortgages were offered to borrowers without sufficient credit or income to qualify for traditional mortgages. These loans often came with high-interest rates and fees, making them difficult to pay down and leading many homeowners into foreclosure.

As a result, banks and other lenders suffered massive losses due to defaults on this risky loan.

However, banks are much more strict when it comes to lending money to everyone. They learned a hard lesson from this experience, and now impose much stricter standards on potential buyers. It is much harder to qualify for a loan than before, ensuring that only those who have sufficient means and credit scores are able to take out a loan. This extra security helps to ensure that buyers can make their loan payments and keep debt levels manageable.

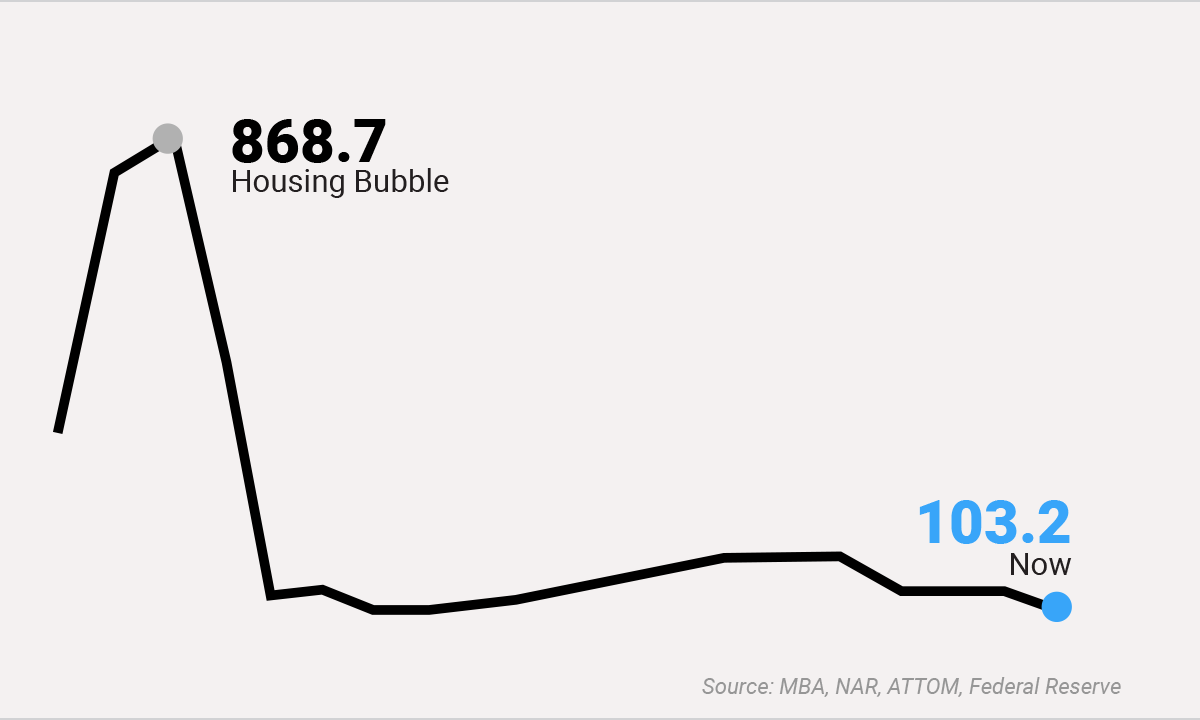

As you can see on the graph, the Mortgage Credit Availability Index (MCAI) which measures the availability or supply of mortgage credit, went down by more than 8.4 times compared to the Housing Bubble peak. This indicates that lending standards are tightening, while increases in the index are indicative of loosening credit.

The number of foreclosures is down

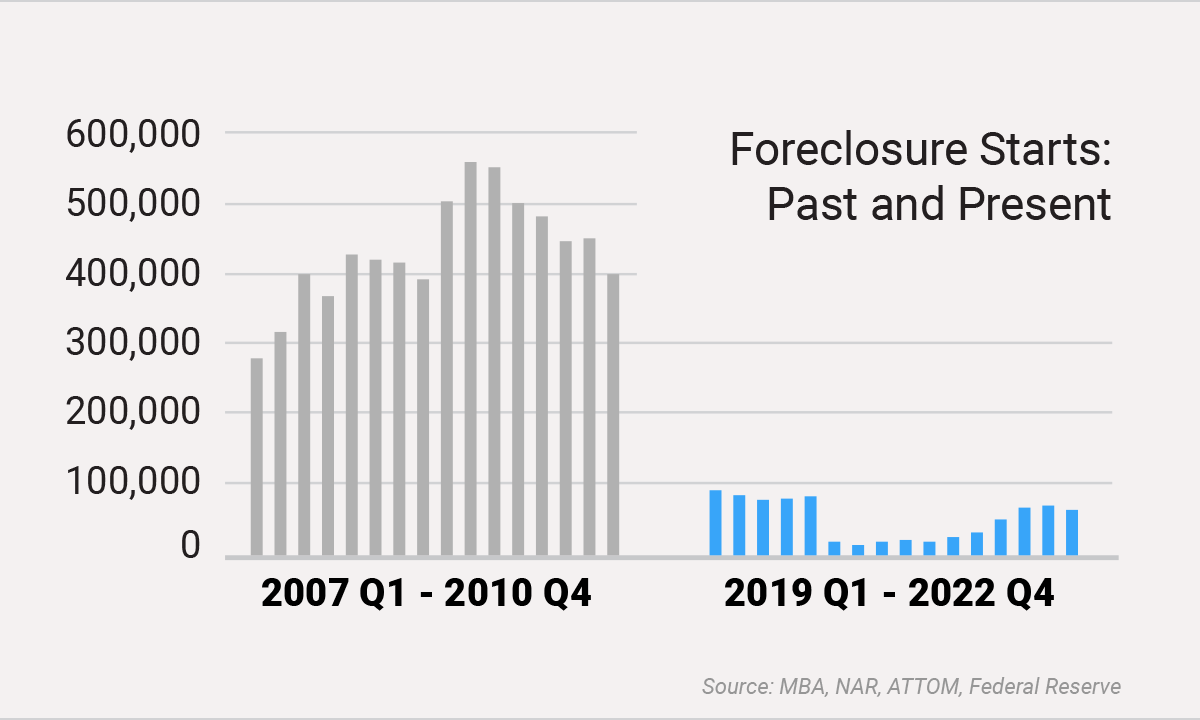

The number of foreclosures is also much lower than in 2008. During the housing market crash, thousands of people were unable to make payments and their homes went into foreclosure.

Today, however, the foreclosure rate is much lower due to stricter lending standards, better economic conditions, and a more stable housing market. This means that fewer people are losing their homes or being forced to sell them at reduced prices. Instead, they are able to stay in their homes by making reasonable payments or finding other solutions that help keep them from defaulting on their loans. As such, homeowners have more security today than during the housing market crash of 2008. This has been a key factor in ensuring the current housing market remains strong.

As you can see on the graph, the number of foreclosures decreased dramatically compared to the global financial crisis.

Less home for sale

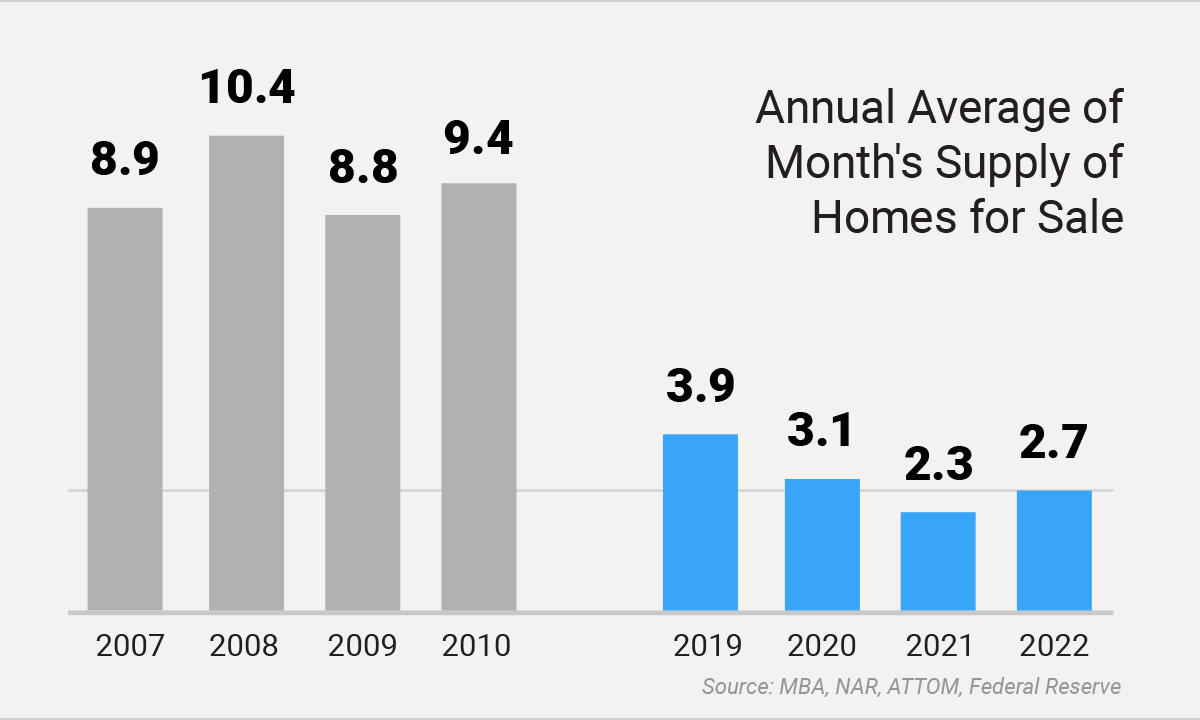

Another factor that shows the housing market is healthier today than it was in 2008 is the undersupply of homes available for sale. During the housing market crash, there were too many houses on the market which caused prices to crash as buyers had so many choices and could bargain for lower prices.

However, in recent years due to increased housing demand, there has been a shortage of housing inventory resulting in higher home prices and more competition among buyers. This helps keep prices from crashing because if people are willing to pay high amounts for a property, sellers will be unwilling to reduce their asking price drastically out of fear of not finding another buyer who would offer the same amount or more.

Therefore, an undersupply of housing creates stability in the housing market and keeps prices from crashing. This has been an important part of keeping the housing market strong in recent years.

The graph below shows that in 2008 the annual average of months’ supply of homes for sale was 10.4 compared to 2.7 in 2022.

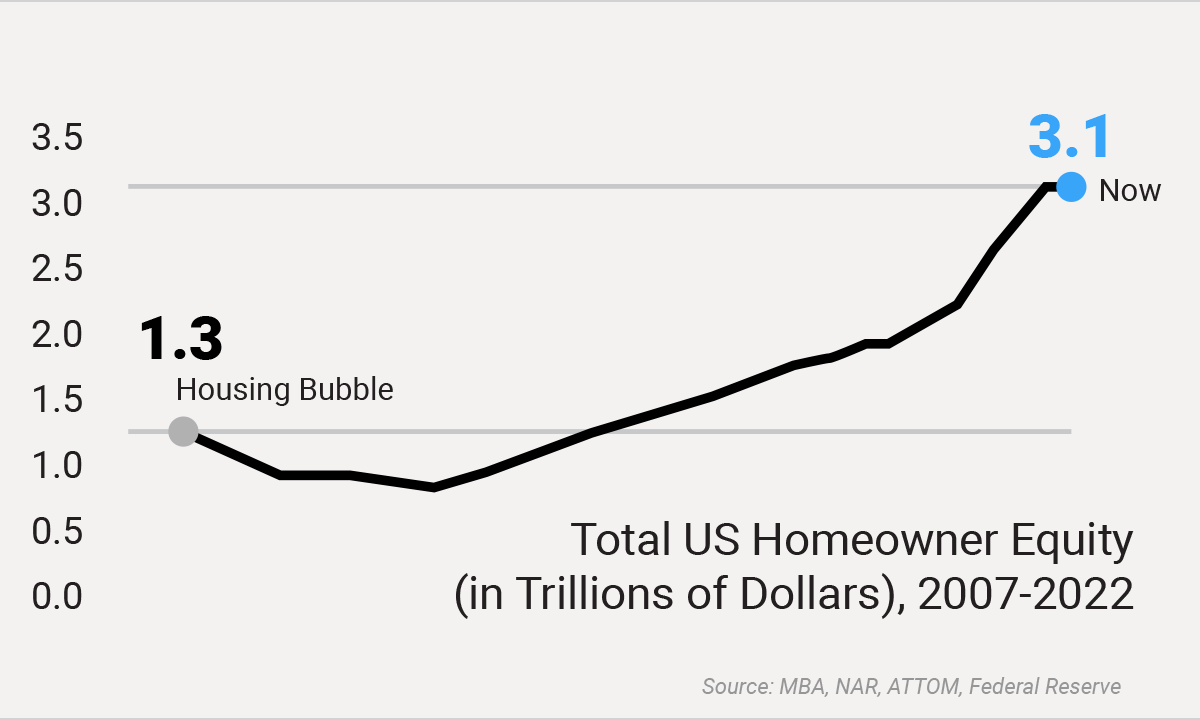

Homeowners have more equity

Another factor that shows the housing market is healthier today than in 2008 is home price gains. Since 2008, housing prices have been on a steady incline with near-record amounts of equity being built for homeowners. This has put them in a much stronger position compared to 2008 when housing prices were dropping and there was no equity available.

This increase in housing values also means that homeowners are better prepared for an economic downturn, as they will be able to leverage their equity if needed. Furthermore, this increase in housing values helps ensure that lenders are less likely to suffer losses from defaults due to increased equity buffers and loan-to-value ratios. Consequently, the current housing market appears much more secure than it did before the housing bubble burst in 2008.

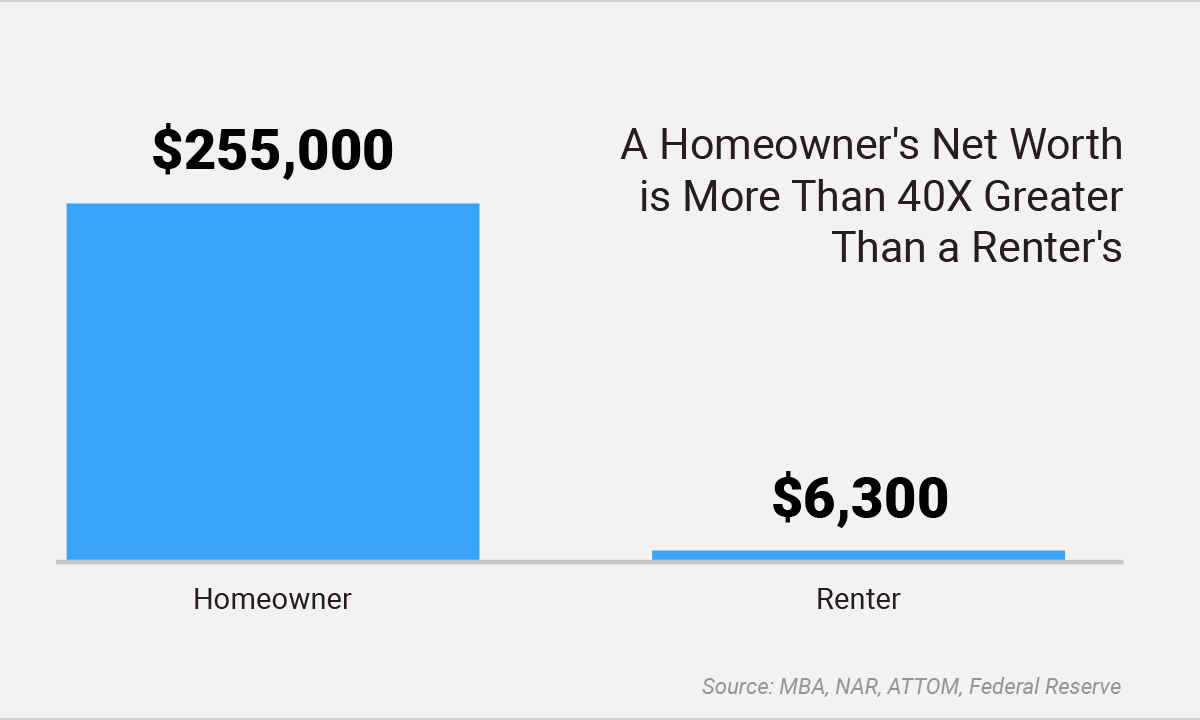

Homeownership is also one of the best investments you can make to build wealth. Over time, housing values tend to appreciate, providing owners with a return on their investment. Furthermore, homeowners can use their housing equity as collateral for other investments or to finance major expenses such as education and home improvements.

As you can see there’s a significant difference between the net worth of the average homeowner and the average renter with homeowners’ net worth being more than 40 times greater.

To conclude, housing markets are much stronger than they were during the Great Recession of 2008 thanks to stricter lending standards, better economic conditions, and fewer foreclosures. Homeowners today have more security than they did during the housing market crash of 2008 and this has been a key factor in keeping the housing market healthy and resilient. So if you’re looking to invest in housing, now may be the ideal time.

Join our community channels

Twitter | Discord | Instagram | Telegram | Facebook | LinkedIn