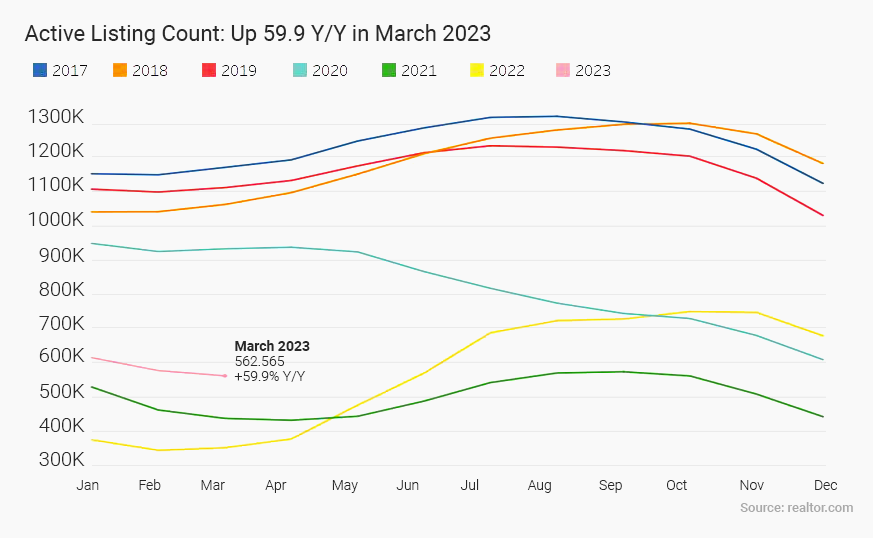

- • There has been a 59.9% increase in the number of homes available for sale compared to the previous year.

- • The number of homes that are still available for sale, including the ones that are currently under contract, has increased by 9.3% as compared to the previous year.

- • The number of homes listed for sale this March decreased by 20.1% compared to last year, indicating that home sellers were less active.

- • In March, the annual growth rate for the median price of homes for sale was 6.3%, which is lower than the growth rate in February.

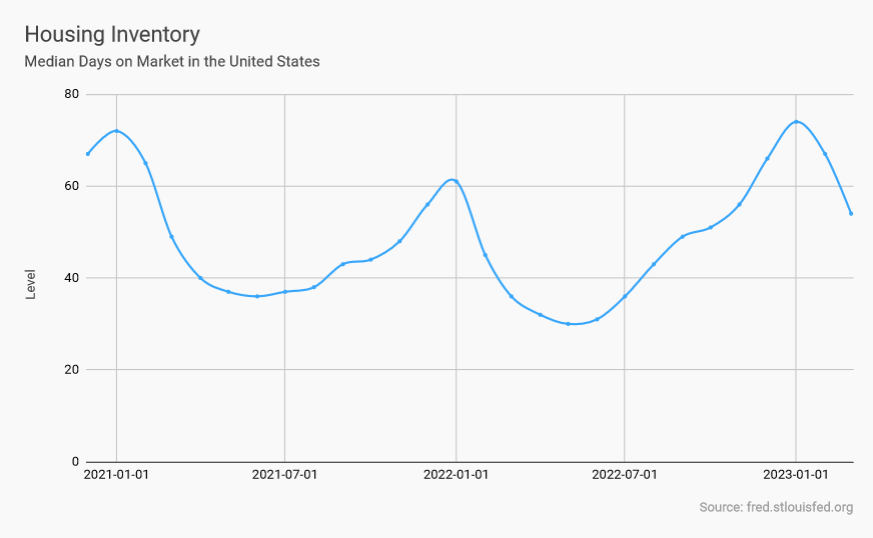

- • The average time for homes to stay on the market was 54 days. This is an increase of 18 days compared to last year, but still shorter than the time before the pandemic.

It’s March 2023, and the real estate market in the US is continuing to evolve. This month’s update from Propy provides an overview of key trends and data points from the past months, including a look at home availability, pricing changes, and more – so read on to get a better understanding of what’s happening in the US real estate market.

With this information, you can make informed decisions about your property investments or purchases. Let’s get started!

Top 10 Cities in the US With the Highest Number of Listings

Mashvisor’s March 2023 report points out the locations with the most active listings. Here are the cities that showed up as the top ten:

- New York, NY: 3,551

- Las Vegas, NV: 3,039

- San Antonio, TX: 2,910

- Miami, FL: 2,207

- Philadelphia, PA: 1,871

- Chicago, IL: 1,817

- Atlanta, GA: 1,778

- Cape Coral, FL: 1,399

- Dallas, TX: 1,223

- Tampa, FL: 762

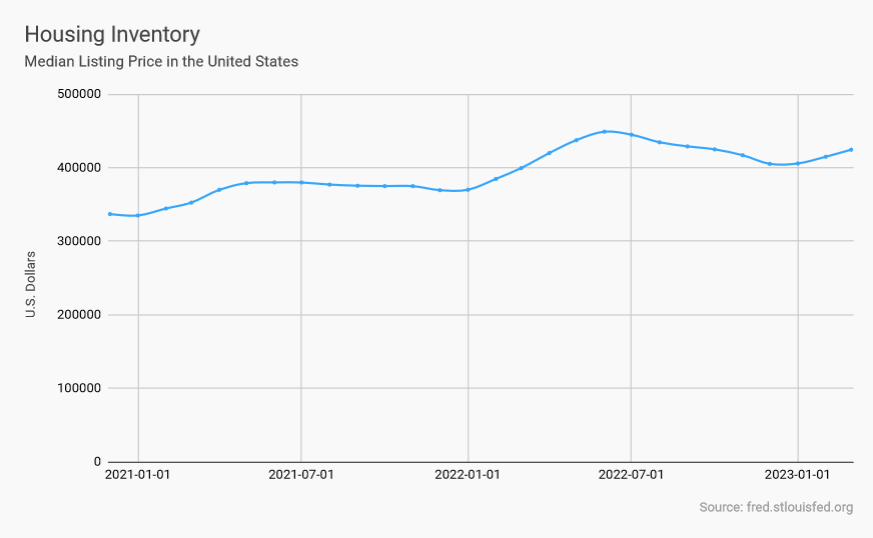

Median Listing Price

In March, the national median list price increased from $414,950 in February to $424,495 according to data from FRED. Although this was a positive development, the figure is still 5.6% lower than the record high of $449,000 in June of last year. However, according to historical data from the past two years (see the graph below), we can anticipate an increase in median prices in April.

Active Listing Count

This significant jump in home availability is an exciting sign for the housing market. Realtor.com® announced that March 2023 saw a 59.9% increase in homes available compared to March 2022, with an additional 211,000 homes on the market. However, despite this sizable boost, it appears that the rate at which the inventory is expanding has slowed down due to fewer potential sellers listing their homes for sale. Unfortunately, this means there are still fewer homes available to purchase than in previous years when taking into account days throughout the month of March. Despite this fact, it’s encouraging news for anyone searching for a new home as more choices become available than in past months.

Total Number Count

Despite the 9.3% uptick in the number of homes for sale since last year, the rate of increase slowed down significantly from last month’s 13.3%. To make matters more complicated, it appears that fewer people were willing to put their homes on the market than a year ago, meaning the growth rate is even lower than the amount of active inventory. This could indicate an increasingly competitive housing market and suggests that potential homeowners would be wise to act quickly if they find something they want.

Days on Market

According to recent data, homes are taking an average of 54 days to sell. While this may seem like bad news for sellers, it’s important to note that this is still a 15-day improvement from the average for March in the years 2017 to 2019 So, why the shift? Experts say that a slower turnover of inventory is to blame, resulting in a higher number of homes available for sale. While it may take a bit longer to close a deal, buyers have a larger pool of options to choose from.

As we transition into the warmer months, the real estate market could heat up (see the data below). Homes could be selling more quickly and the days on market are expected to decrease over the rest of 2023. For many, the search for a new home is now in full swing as the spring season brings new hope and opportunities.

What about the mortgage rates?

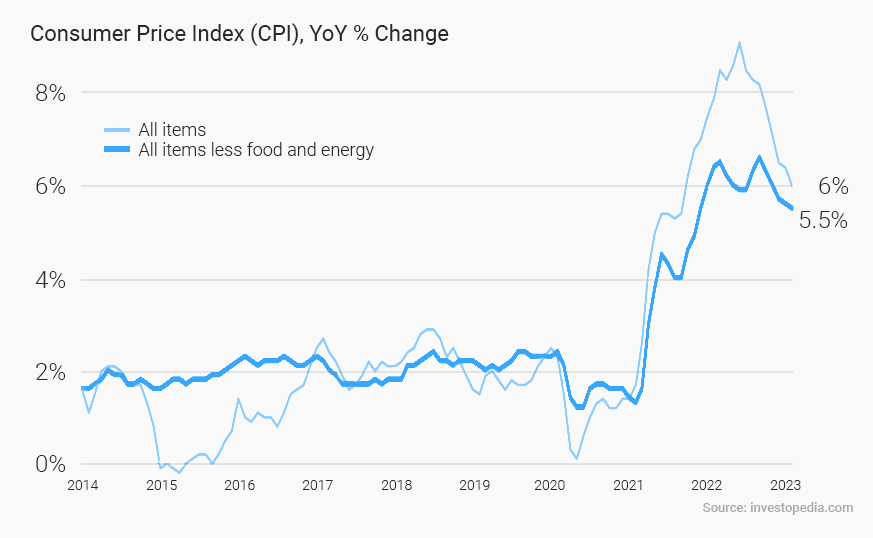

The Federal Reserve’s recent decision to hike the federal funds rate by 25 basis points in March shows their continued commitment to containing inflation. This move brings the new rate range to between 4.75% and 5%. While the Fed has hinted at more rate increases in the future, they plan to take a more measured approach with smaller hikes in 2023. This decision follows on the heels of seven benchmark interest rate hikes in 2022. Clearly, the Fed takes its role in securing the economic well-being of the nation quite seriously.

Following the meeting in March, the Fed shared that “some additional policy firming may be appropriate” in order to bring inflation to its target rate of 2%. Experts think that the Fed may be thinking about pausing on tightening. In March we saw some high-profile banks like Signature Bank and Silicon Valley Bank collapse. Additionally, inflation continues to cool, falling to 6.0% in February from 6.4% the previous month, according to the latest Consumer Price Index (CPI) report by the Fed.

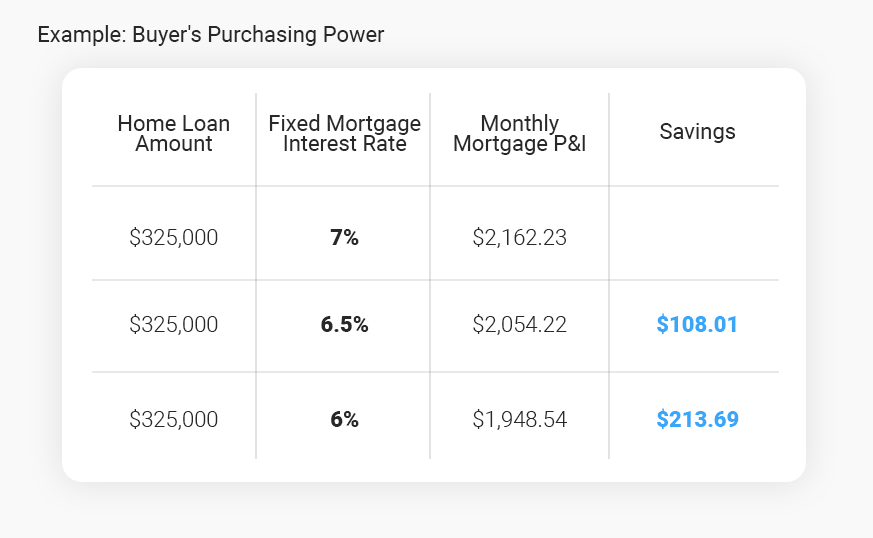

How a 1% or even a 0.5% shift in mortgage rate could affect purchasing power? The chart helps show the general relationship between mortgage rates and monthly mortgage payments:

Even if homebuyers may hope for the rates to fall, that could be too risky. No one could predict 100% where the interest rates will be, even experts. Lisa Sturtevant, PhD, Housing Economist at Bright MLS, shares: “It is typically a fool’s errand for a homebuyer to try to time rates in this market… But volatility in mortgage rates right now can have a real impact on buyers’ monthly payments.”

According to Forbes one of the key factors that home buyers, sellers, and housing agents are watching closely this spring are:

- • high inflation

- • interest rate

- • ongoing geopolitical uncertainties

- • recession fears

Despite the recent bank problems, caused by the higher interest rates according to some experts, the Fed calls the banking system “sound and resilient”. On the inflation front, the Fed’s projected 2023 core inflation growth rate is 3.6% – still higher than the target of 2%.

The next FOMC meeting is scheduled for May 2-3 but before making the decision about the interest rates the Fed will look at the Inflation report for March (April 12) and the Job report.

How about property tokenization?

As more and more people immerse themselves in the metaverse and explore the latest cutting-edge AI and blockchain innovations, banks are taking notice. They too are relishing in the possibilities that come with the tokenization of real-world assets.

One of the leading financial institutions, Citi Bank, recently shared in a report that they believe tokenization will be the key driver behind the widespread adoption of crypto. The bank has even estimated that private markets “could be the killer use case” for blockchain technologies, estimating that tokenization could “grow by a factor of 80x in private markets and reach up to almost $4 trillion in value by 2030.”

Predictions on the market

Most industry insiders and experts are optimistic about the mortgage rates and think that they will continue to go down as the US economy slows. In the latest report by Norada Lawrence Yun, the chief economist of the National Association of Realtors, said he expects rates to fall to 5.5 percent by mid-2023. Fannie Mae believes that the average rate of a 30-year fixed getting to 6.8% in 2023. Meanwhile, the prediction from Freddie Mac is 6.4%.

The Mortgage Bankers Association (MBA) also expects rates to fall in 2023 as its economists predict that the US will enter a recession during the first half of the year. The rates for 2023 may conclude at about 5.4%, according to the group.

Overall, there has been a decrease in pending listings and newly listed homes, while mortgage rates and median listing prices remain higher than last year. Although there are optimistic signs that suggest a recovery is underway, there’s still uncertainty regarding how long it will take for the housing market to fully recover.

Join our community channels

Twitter | Discord | Instagram | Telegram | Facebook | LinkedIn