Buying a home is a massive investment, one which you may wish to make in the coming months or years. If you have not previously purchased a home, you may not understand the intricacies of the process. That is okay, as you will have agents and lenders who are more than willing to hold your hand as you go along. However, if you can manage to do a few things correctly the first time, then you will be thanking yourself for years to come for setting yourself up with the right property for your unique situation.

Make Sure You Have Enough Money for the Mortgage

There is such a thing as being “house poor.” It means having a home that takes up too much of your monthly income to the point where you have trouble paying for other essentials. Make sure that you can afford your mortgage with plenty of money to spare. Take into account any worst-case scenarios, such as the potential loss of a steady job or a relationship. If you could still afford the home, then move on ahead.

Account for Property Tax and Homeowners Insurance

In most cases, taxes and insurance costs will be rolled into your monthly bill. Ask your agent ahead of time if this will be the case, and take note of the final sum. If you have to cut checks separately, then make sure that you have the money to pay them.

Property Maintenance Ability

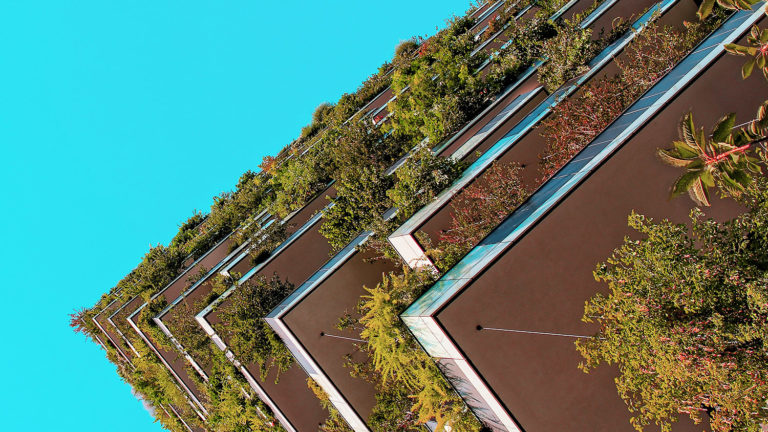

Do not buy property on land that you cannot maintain. Too much yard, forest, or landscaping can be a terrible burden if it is beyond your ability to keep the area looking presentable. If you cannot handle it, you will have to hire someone who can, and this is just another expense for which you should budget.

Have a Good Credit Score

Work on your credit score by eliminating debt and exhibiting responsible credit behaviors. When your credit score is high, lenders will give you money at lower interest rates, which can help you save thousands over your loan period.

If you are ready to pay the full price for a property, choose Propy’s Transaction Platform for closing the sale. It will bring your transaction time down from days to hours, save you money, and offer you airtight security through every step of the process.