Two years ago, for the first time in the world, a physical asset was transferred via blockchain-based smart contracts. The case is unique, not only because it was the first record of a real estate transaction on the blockchain and the first government-approved asset transfer on the blockchain, but also because smart contracts took over the Escrow process. What is notable is that smart contracts that play the role of the Escrow or the settlement process do not require the involvement or the approval of governments.

In the historical real estate transaction in Ukraine, the payment was made in cryptocurrency. A smart contract held the cryptocurrency until the ownership transfer was done via a local notary. The notary logged into the Propy interface and confirmed the transfer of ownership after other relevant paperwork was executed on Propy’s platform by the remote buyer and the seller. Once the transfer of ownership was completed with the registry of Ukraine, the funds, which were $60 thousand in cryptocurrency, were automatically released and distributed by smart contracts.

2019 takes us further down the road of advancement. Now, a similar settlement process via smart contracts is possible for traditional residential transactions in the U.S., with U.S. dollars. Imagine that, one day, the payment for a property and the transfer of ownership could happen simultaneously; this is possible only with software.

Up until now, Escrow companies (or notaries or closing attorneys) would guarantee that if you send money, ownership would be transferred; these are trusted parties that have special licenses to verify the transaction. However, one day, software will be able to complete the settlement instantly.

All over the world, the three conditions for a transaction settlement are the same. They involve the purchase agreement, the payment, and the ownership transfer.

The rules for the closing are the same, as well. If you complete the paperwork, then you can send the money. If you send the money and the property ownership is clear, then the ownership is transferred, and the payment is released to the seller.

The “if” and “then” rules are programmable and can be put in a code. The best solution for this type of self-executing code today is a smart contract, due to its unhackability.

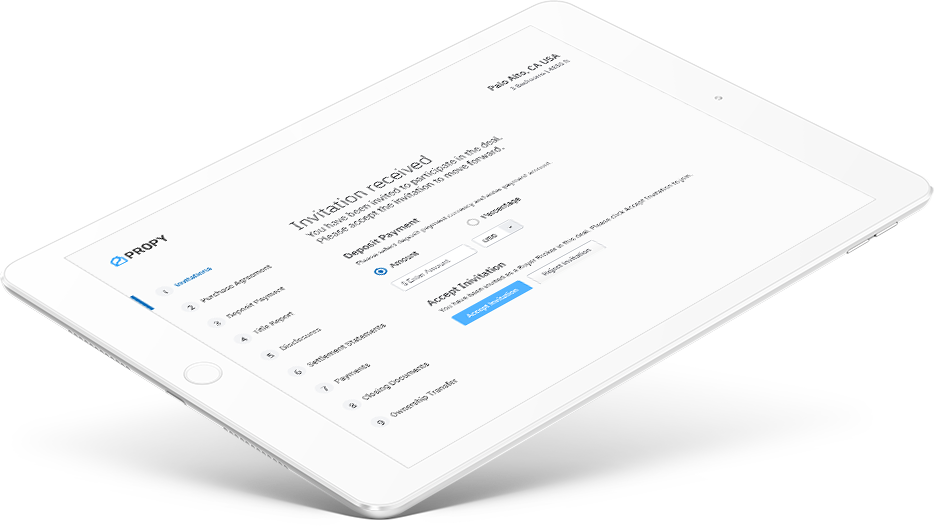

Propy was able to build a Transaction Platform which processes the entire paperwork between participants, as well as wire payments and e-recording. Every single step of a transaction is a part of the underlying settlement product. With Propy, the system knows instantly and securely when the parties sign paperwork, when the wire transfer gets initiated and finished, and when the ownership is recognized as clear. Thus, smart contracts can enforce e-recording and the release of the funds.

All of the above make up a settlement software for a real estate transaction. Such software has never been in place in the United States, as far as we know. There have been cases with settlement via software in other countries, but these happened without smart contracts. One such company was acquired for over $1 billion last year.

While the property-buying process via smart contracts might seem complicated, it is actually very simple. Here is a video:

What Are the Promises of Settlement via Software?

There is no need for an Escrow agent to manually verify the bank’s transfer and paperwork and input key metadata. There is no need for a county clerk to manually record the deed to the recording system and input key metadata. With the traditional process, the same data has been filled out many times throughout the transaction, and, by the time it gets to the recording office, it produces 20% of mistaken recordings. With settlement via software, instead of closing in 30 days, you will be able to close within a week, one day, or even perhaps hours at one point. Even more, expensive mistakes and $2 billion in fraud will be eliminated.

The byproduct of such a settlement is the elimination of wire and title fraud. It is because, with the Propy payment gateway, the buyer never goes to the bank and thus is not exposed to fraud. Propy initiates the payment from the buyer’s account. Additionally, because the county’s recording office will only receive grant deeds of the transactions that have settled on the platform with all documents, proof of payment, and all participants’ signatures, it is almost impossible to make a fraudulent transaction.

Wire fraud increased from $200 thousand to $2 billion in the last four to five years, due to the digitalization of the transaction. So, a need exists for new technologies to step in and resolve the fraud issue. (Please note that the Internet’s main application is an exchange of data, while blockchain technology’s main application is an exchange of values; thus, it is an unhackable way to build the settlement process.)

The settlement system will offer the “Amazon” experience for real estate transactions. Amazon’s settlement system is simple. You pay for a product, sign the terms, and share your address. Then, vendors deliver the product, and you own it. Here, Amazon is the guarantor and the Escrow of the transaction. If you do not receive the product, then you will get a refund. In real estate, you receive a grant deed, and the logistics in real estate involve the inspectors, the title reports, the recording office, etc.

With an automated settlement system, we can finally see real estate deals taking place in the e-commerce field. A new generation of marketplaces like “Zillow” or “Zoopla” will evolve, and they will be transactional marketplaces.